Mutual fund investment is a great way to grow idle money in the long term. With 44 Asset Management Companies (AMC) in India and over 2000 schemes, tracking them can be cumbersome. However, with the best mutual fund apps in India, you can easily track, manage, and invest in different schemes on one platform, as well as track all your external mutual funds from the same place. In this article we will explore the 5 Best Mutual Fund Apps in India. If you are looking for a guide about this, read this article till the end.

Features in Good Mutual Fund App

Choosing the best investment app in india is a quite diificult task, but if you considered the undermentioned features while choosing the investmenet, you may get very good results.

5 Best Mutual Fund Apps in India

Mutual fund apps for Android and iOS devices offer various features for investment, including direct investment in SIPs and lumpsum purchases. These apps allow users to track NAV, manage their portfolio, and create online SIPs from home. Some also assist in registering for new paperless KYC. These apps are considered the best for direct investment in India. Let’s explore each app one by one.

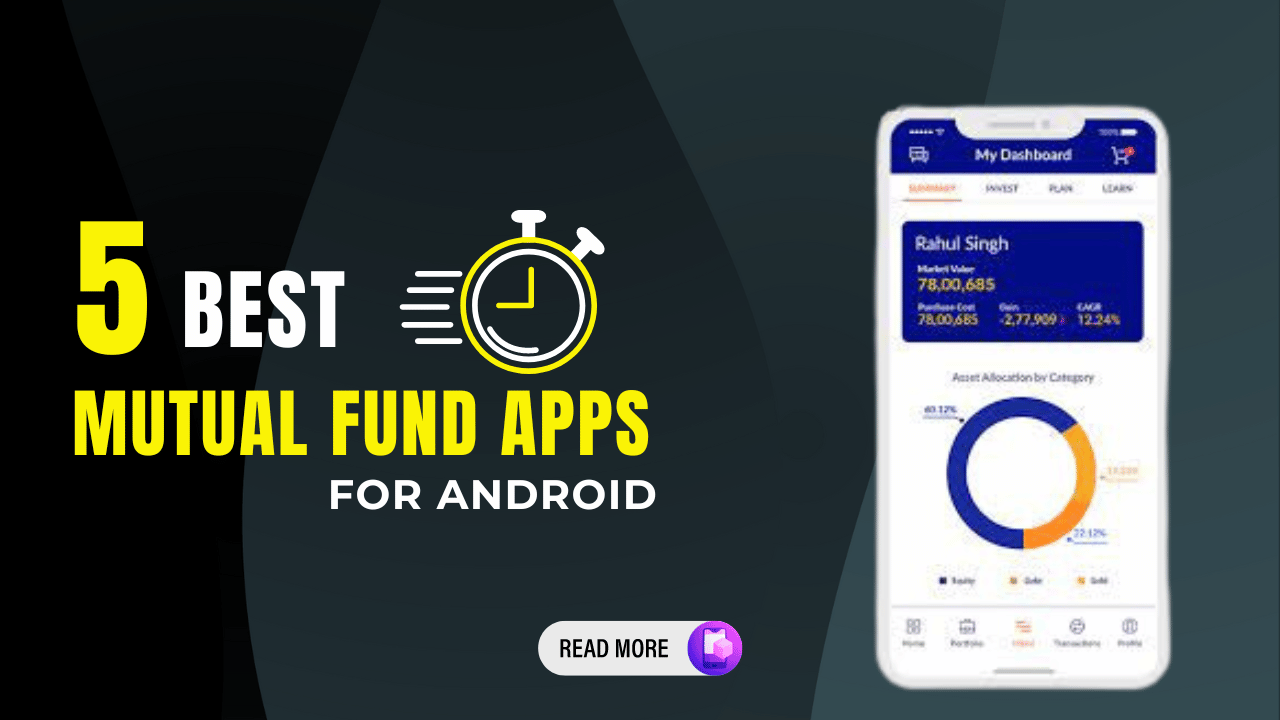

myCAMS App

MyCAMS is an RTA that manages the AMC of Mutual Funds, including Aditya Birla Sunlife, DSP BlackRock, HDFC, HSBC, ICICI Prudential, IDFC, IIFL, Kotak, L & T, Mahindra, Parag Parikh MF (PPFAS), SBI, Sriram, Tata, Union, Sundaram, and BNP Paribas MF. MyCAMS is the best mutual fund app in India for direct investment, tracking new Funds Offers (NFO), starting new SIPs, and purchasing lumpsum MF units. The app offers a 4-digit Passcode or Pattern type login feature, allowing users to start digital SIPs within 7 days of registration. Let’s Checkout the features of MyCAMS app.

MyCAMS App Features:

MyCAMS App DrawBack:

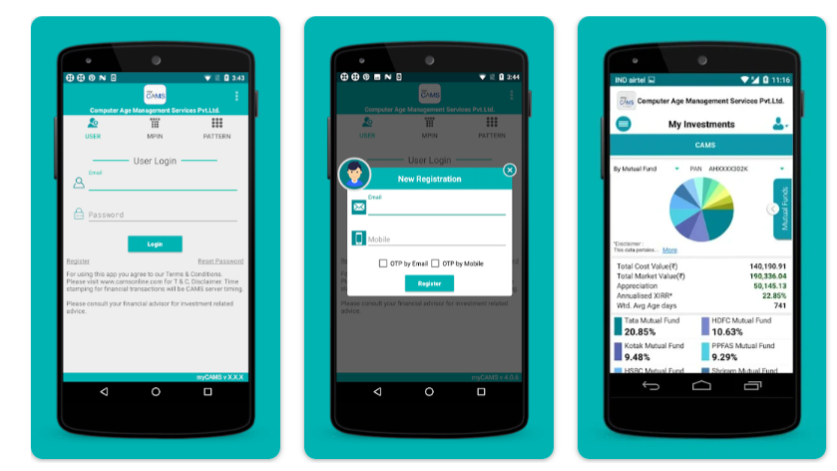

KFinKart

KFinKart is a mutual funds app by Karvy MFS, allowing users to manage, track, and invest in various mutual fund houses in India. The app offers features such as Axis Mutual Fund, Baroda Pioneer Mutual Fund, BOI AXA Mutual Fund, Canara Robeco Mutual Fund, DHFL Pramerica Mutual Fund, Edelweiss Mutual Fund, Essel Mutual Fund, IDBI Mutual Fund, Indiabulls Mutual Fund, Invesco Mutual Fund, JM Financial Mutual Fund, LIC Nomura Mutual Fund, Mirae Asset Mutual Fund, Motilal Oswal Mutual Fund, Principal Mutual Fund, Quantum Mutual Fund, Reliance Mutual Fund, Sahara Mutual Fund, Taurus Mutual Fund, and UTI Mutual Fund.

KFinKart App Features:

KFinKart App DrawBack:

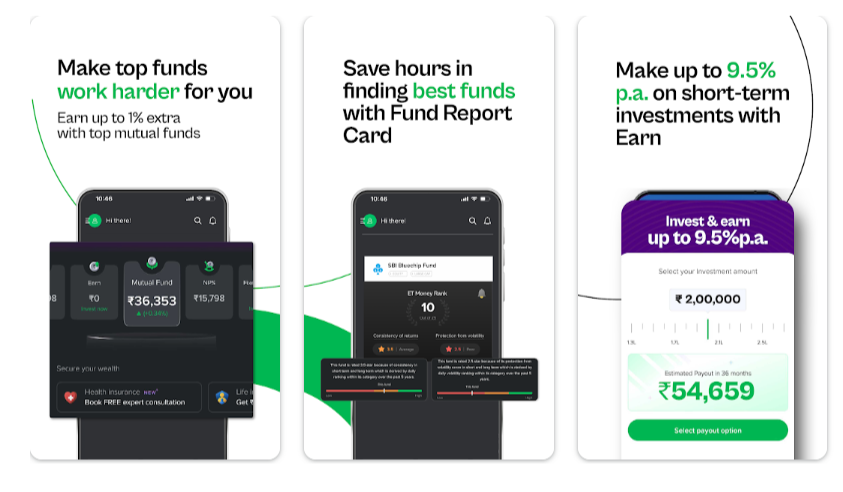

ETMONEY

ETmoney is a comprehensive SMS-based money manager by Times of India Group, offering direct schemes of mutual funds and a single platform for managing spending and tracking external investments. Users can sign up digitally with valid PAN and OVD documents, and in-person verification can be done using the phone’s camera. The app offers multiple investment options for various deposit and insurance schemes, including ELSS, Tax Savings, and health insurance, with KYC verified status required. ETMoney Genius allows users to create an expert-based goal-oriented mutual fund portfolio for small charges. Let’s discuss about the features and drawbacks of this amazing app.

ETMONEY App Features:

ETMONEY App Drawbacks:

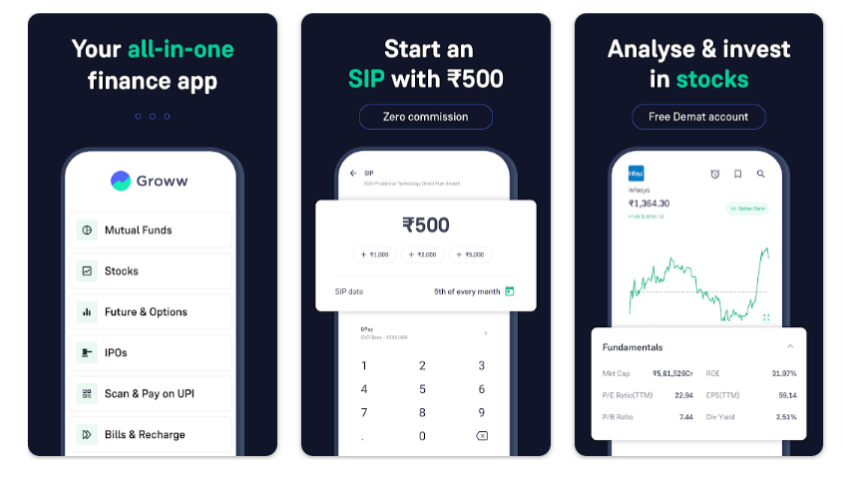

Groww App

Groww is a discount broker and mutual fund app that offers direct investment in multiple schemes with zero commission. The Groww app allows users to switch between regular investment funds and direct schemes for free. New investors can create an investment account digitally using Adhar eSing, PAN verification, and linking bank accounts. The app also allows users to add or withdraw funds to their Groww wallet and invest in mutual funds without logging into their bank’s website. UPI Payment is enabled for instant fund addition. The Groww app allows easy tracking of external Mutual Fund investments, with the app fetching them within minutes or directly via Gmail. Users can invest in over 5,000 schemes from all 44 AMCs in India, with their units stored in CDSL or NSDL demat accounts. Let’s checkout the features and downsides of this app.

Groww App Features:

Downside of Groww app:

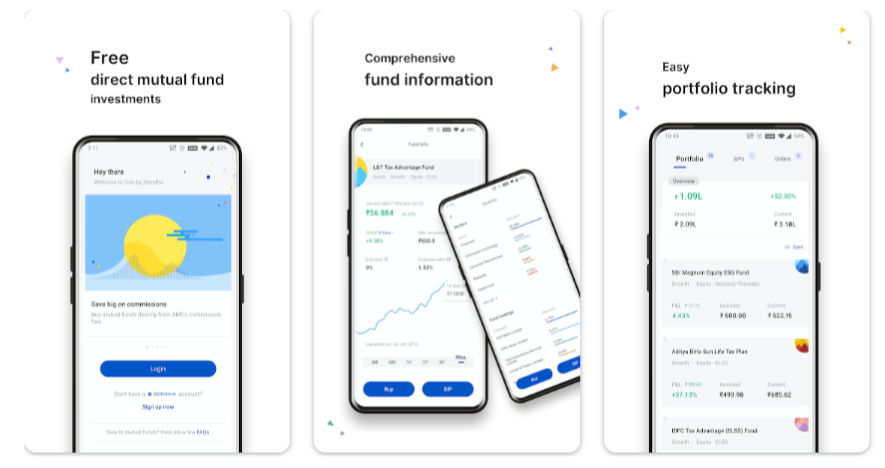

Zerodha Coin

Zerodha, India’s leading discount broker, offers the Coin app, a free Mutual Fund investment platform. Users can invest in direct schemes or start fresh SIPs with a Zerodha trading and demat account. The app allows users to create a free trading account and complete KYC processes from mobile. Units purchased from the Coin app are stored in Zerodha’s CDSL or NSDL demat account. Users can also create eMandates for direct debits and invest in Exchange-traded Funds. Let’s move to checkout the features and explore more information about this app.

Zerodha Coin Features:

Zerodha Coin Drawbacks:

Final words

If you have any query about this, simply contact us by using comment section, contact us page or through email.

We recommend you bookmark our website in your browser to access updated information like this. If you want to read more informative articles like this, read our blog section.

Read Also:

Disclaimer:

Our Website ApkHul.com is a promotional and informative Blog website. We post blogs and applications for introduction and information purposes only. ApkHul.com is not responsible for any issues.

Thanks